I want you to look at your bank account. Seriously, do it right now.

Do you know exactly what that $14.99 charge from "DIGITAL RIVER" is? How about that random $4.50 coffee? Did you actually buy that, or is it a subscription you forgot to cancel three months ago?

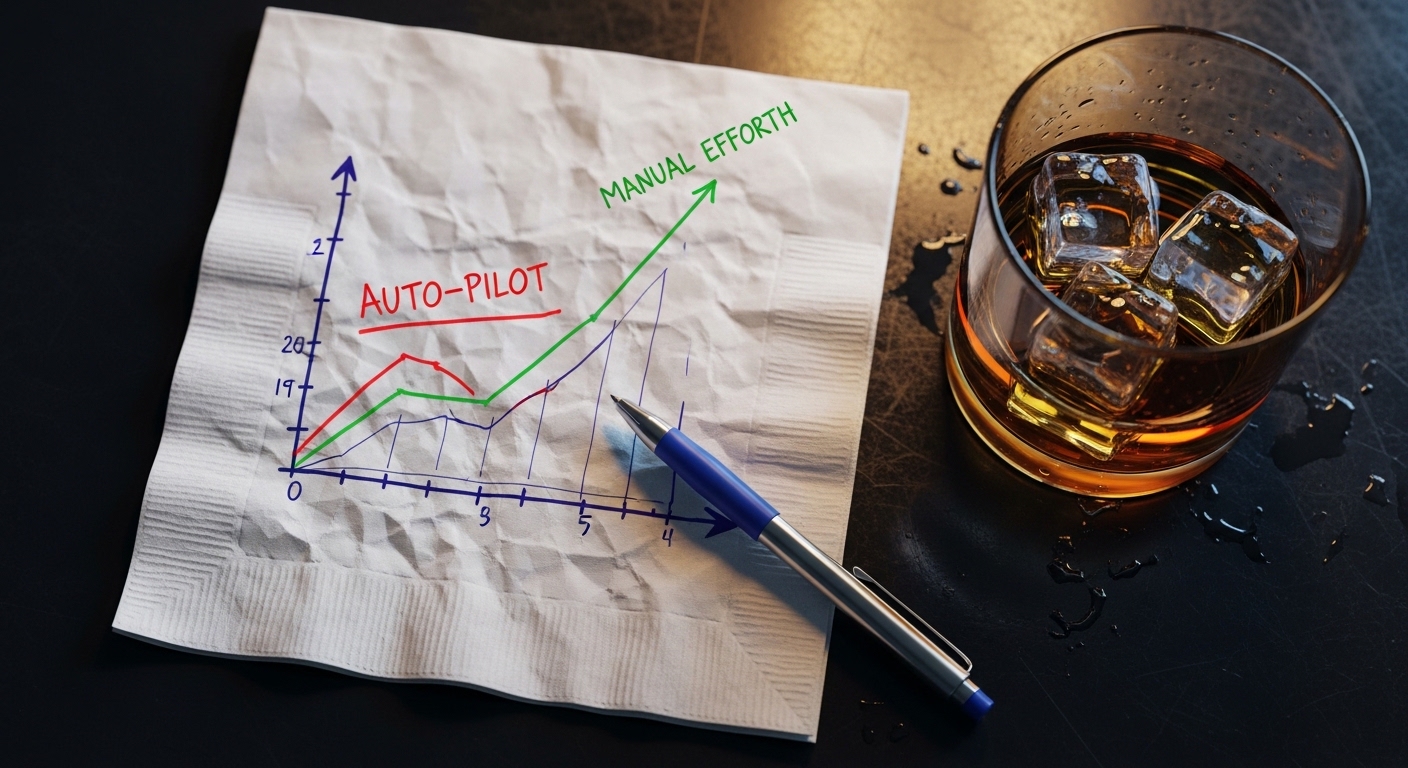

We've been sold a lie. The tech giants told us: "Automate everything. Link your accounts. Let the AI handle it."

It sounds great. It feels modern. But after analyzing spending data from thousands of users, I've come to a different conclusion: Automation is making us mindless. And mindlessness is expensive.

The "Gym Membership" Effect

Gyms love automation. Their entire business model relies on people signing up in January on auto-pay and never showing up in March. If you had to manually hand over $50 cash at the front desk every month, you’d cancel the second you stopped going.

But because it silently hits your credit card in the background? You let it slide. "I'll go next week," you tell yourself. Six months later, you're out $300.

This is the Automation Paradox: The easier it is to pay for something, the less value you demand from it.

Why Friction is a Feature, Not a Bug

I track every single penny I spend. Manually.

"That sounds exhausting," my friends tell me. "Why not just use Mint or Rocket Money?"

Because I want to feel the pain of spending money.

When I buy a $6 latte, I have to pull out my phone, open Finly, and say "Six dollars for coffee." That split-second of effort forces a micro-reflection: Was this worth it?

- If the answer is yes? Great. I log it and move on.

- If the answer is no? I feel a tiny sting.

That sting is powerful. It’s a feedback loop. Your brain learns. Next time, maybe I skip the latte. With automated apps, there is no sting. You just get a colorful pie chart at the end of the month telling you that you already failed.

The "Set It and Forget It" Trap

Automated trackers are great at telling you history. They are terrible at changing behavior. They are autopsies. They tell you how you died financially, but they don't stop the bleeding.

Manual tracking is preventive medicine. It happens in the moment. It interrupts the impulse.

But... I'm Lazy.

I get it. Typing "Chipotle - $14.23 - Food" is annoying. That’s why I built Finly. I wanted the psychological benefit of manual tracking without the tedium of data entry.

With Finly, I just say: "14 bucks at Chipotle."

It takes 3 seconds. It fulfills the ritual of acknowledging the spend. But it doesn't feel like work. It's the sweet spot between "mindless automation" and "painful spreadsheet management."

The Challenge

Try this for 7 days. Don't look at your automated dashboards. For one week, manually log every single thing you buy. A pack of gum. A Netflix renewal. Rent.

I guarantee you two strings will happen:

- You will spend less money. (The "Observer Effect" applies to finance too).

- You will feel more in control than you have all year.

Stop outsourcing your financial awareness to an algorithm. Take the wheel back.

Ready to mute the noise?

Join the Anti-Automation movement. Track meaningful spending in 3 seconds or less.

Start Manual Tracking